1. Welcome

1.1. This page sets out the terms and conditions that apply to the Custody&Vault accounts and its application to our Service.

1.2. By using the Custody&Vault accounts, you agree to these terms and conditions.

1.3. These terms, combined with the General Terms and Conditions, and any other documents referred to in these set out the legal agreement between:

You, as the user; and The EQapital Trust company that provides you with services as defined in our General Terms of Service (“EQapital Trust”, or “we”, “our”, or “us”).

Capitalised terms defined in the General Terms of Service (the “Terms”) have the same meanings when they are used in these Terms.

1.4. Please read these Terms carefully and make sure you understand and agree to them before using our Custody&Vault accounts.

2. Definitions

2.1. “APY” means annual percentage rate (which is used to calculate projected rewards).

2.2. “Lock up period” means the period of time, specified in months, for which the deposited funds are not accessible and are accruing rewards as a loan for the Real Estate Operations.

2.3. “Deposit Date” means the date on which the client has deposited funds in one of our accounts.

2.4. “Maturity Date” means the date on which the account conditions have been completed, rewards stops to accrue and the deposited funds are available to be withdrawn.

2.5. “EQapital General Terms of Service” means the EQapital terms and conditions.

2.6. “Real Estate Operations”, these are properties such as land, apartments and houses that are purchased for their subsequent renovation and resale or lease (or both), and the acquisition of properties in projects under construction in strategic tourist areas seeking both a surplus value upon delivery of the property with its future resale than a further return with the rental of the property.

3. Tax

Earnings may be subject to tax in your jurisdiction. You are responsible for paying any tax due on any interest received. You should seek professional advice if you are unsure about whether you need to pay any tax and/ or how much tax you need to pay. EQapital will not be responsible to you for any amounts you are required to pay in tax or any penalties you face.

4. Changes to current plans

4.1. Changes to current plans may happen at any time without notice to you. Where possible, we’ll give you one month’s notice before making changes to the current plans.

4.2. Changes to the current plans will affect only to accounts opened after the date of change.

5. Limitation of Liability

5.1. EQapital Trust reserves the right at any time and from time to time to modify or discontinue, temporarily or permanently, accounts with or without prior notice due to reasons outside its control (including, without limitation, in the case of anticipated, suspected or actual fraud).

5.2. We may also modify or discontinue accounts on reasonable notice to you. If we discontinue any of our program, we will honor any rewards for which you have become eligible as per the conditions of the discontinued program indicated below.

5.3. EQapital Trust accepts no responsibility for any loss or damage incurred or suffered by you as a result of availing the program or accepting or using any rewards, including (but not limited to) any loss resulting from the following:

a) any postponement or cancellation of accounts or any delay in crediting any rewards to your Eqapital Trust Profile;

b) any alteration, unauthorized access, damage, late delivery or non-delivery of any notices, acceptances, requests or other documents related to our accounts;

c) any loss of value of the assets held in our accounts;

d) any act or default of any third-party supplier or any of our Partner Platforms.

5.4. Nothing in these Terms shall exclude the liability of EQapital Trust for death, personal injury, fraud or fraudulent misrepresentation as a result of its negligence, or any other matter for which the law does not allow us to exclude or limit our liability.

6. Your personal details

Please see our Privacy Policy for more information about how we handle your information.

7. Disclaimers

Please note that we do not offer regulated investments through the platform. Therefore we are not authorised or regulated by any Financial Conduct Authority. This product does not constitute a ‘deposit’ under applicable law;

8. Risk

Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless.

9. General

9.1. We intend to rely on these REIT Accounts Terms as setting out the written terms of our agreement with you for your availing of the REIT program. If part of these REIT Accounts Terms cannot be enforced then the remainder of the REIT Accounts Terms will still apply to our relationship.

9.2. If you have any questions about the REIT Accounts program or these Terms & Conditions, please contact us via help@eqapitaltrust.com.

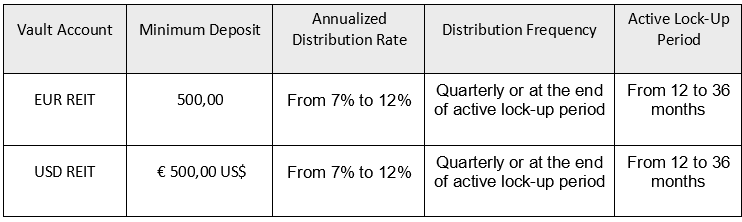

10. USD REIT Account

10.1. DEFINITIONS

“Inactive Lock-up Period” is a period with a minimum duration of 1 month and a maximum of 3 months, in which the client can make their deposits. At this stage the deposited funds will not generate interest income. The inactive lock period ends at the end of the countdown which can be consulted from eqapitaltrust.com/realestate and on the specific project web page.

“Active Lock-up Period” is a period in which the deposited funds will be activated as a loan for the real estate operation. This phase will begin once the minimum deposit targets are achieved.

“Dashboard” is the exclusive area where the customer can find updates on the implementation market data, the transactions in progress and to which operation their deposits is associated, information about financial position confirming the conditions of participation and instructions on how to enter in new operations or how to withdrawals.

10.2. SUBSCRIPTION

To participate in real estate operation through EQapital Trust’s USD REIT, the client can make a deposit (SEPA or SWIFT) into his EUR REIT or USD REIT account. For those who are already customers, it will be enough to make an internal transfer from their EQapital Trust’ accounts.

The client has the possibility to add to their initial balance with multiple deposits during the Inactive Lock-up Period phase which, as described above, has a minimum period of 1 month and a maximum of 3 months.

10.3. REQUEST EARLY REPAYMENT

It will not be possible to request the return of funds deposited in EUR REIT or USD REIT accounts before the natural expiration of the Active Lock-up Period or before the expiration of the additional period, as described below.

10.4. RETURN OF PRINCIPAL AND REWARDS

At the end of the Active Lock-up Period the customer will receive a report via e-mail with information about the end of operation, instructions to transfer the funds or re-apply them in the next operation under new conditions visible at eqapitaltrust.com/realestate and on the specific project web page.

Payment of REIT Rewards will depend on the proposed conditions that can be found at eqapitaltrust.com/realestate

The return of principal and REIT Rewards, can be quarterly, or at the end of the Active Lock-up period.

10.5. ADDITIONAL PERIOD

In order to protect the operation from unforeseen events where the real estate operation does not end within the established period, the client will be paid an additional REIT Rewards on the deposited amount of 1% per quarter up to a maximum of 6 months.

10.6. GENERAL CONDITIONS

If the individual client is unable to achieve the minimum deposit or if the minimum fund necessary for EQapital Trust to activate the real estate operations is not achieved, the active Lock-up Period will not be entered. In this case, the client will receive an e-mail with a report indicating the status of their deposits and containing instructions on how to withdraw the funds. Instructions on how to leave the funds available to participate in the next real estate operation will be included in the same report.

The client who deposited into the EUR REIT account will be advised to request funds to be transferred to their USD REIT account before the phase enters the Active Lock-up Period.

Before activating the deposits and entering the Active Lock-up Period, EQapital Trust will send the client a report with information about the conditions of the client’s participation. The report will be sent to the e-mail address of the customer registered in the EQapital Trust Custody&Vault system and will be visible there as well as at https://my.eqapitalreit.com.

Before making deposits to the USD REIT account, please visit eqapitaltrust.com/realestate and/or the specific project web page to consult the conditions of deposit for the current period.

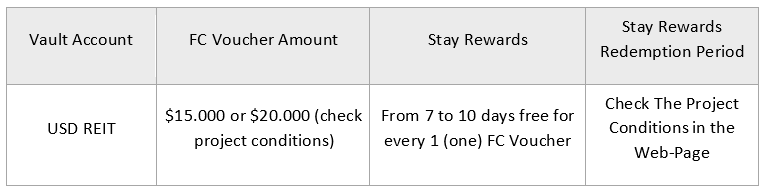

11. Stay Rewards

11.1. DEFINITIONS

“First Class Voucher or FC Voucher”, each FC Voucher, depending on the project, will have a value between $15,000 and $20,000 or multiple. The amount of the FC Voucher will be visible on the specific project web page. The customer will be able to use his FC Vocher in accordance with the conditions explained below.

“Stay Rewards” is composed by a total of days that the client can stay for free in one of our Real Estate properties.

“Stay Rewards Redemption Period” is the specific period of time in which the reservation of the days in one of our units can be made.

11.2. GENERAL CONDITIONS

The Stay Rewards fully replaces the REIT Rewards mentioned in the USD REIT Conditions. If the client deposit will be sufficient to cover the value of at least 1 (one) First Class Voucher, the client will receive a report via e- mail containing instructions regarding the times and procedures of its activation and how the Client have to confirm the choice of type of Rewards.

Stay Rewards include only the costs for the stay together with all the services that the condo/tourist complex offers included in the stay. All other costs, such as transport and local expenses will be at the customer’s expense.

The period of stay chosen by the customer in one of our properties will be booked by the customer directly through the use of online reservation platforms used and made available by EQapital Trust. At the time of booking by the Client, these platforms will regulate the liability relationship between the parties in this case between the Client, the tenant and EQapital Trust, owner of the real estate unit. These responsibilities refer to living expenses and costs, instructions on the proper use of the real estate unit and guarantees.

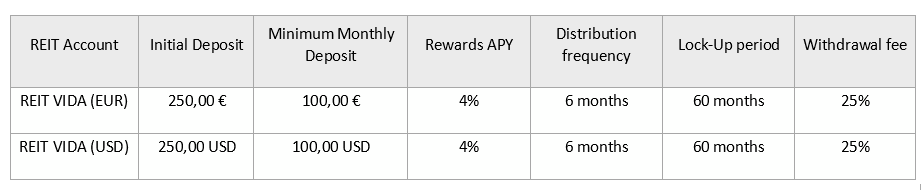

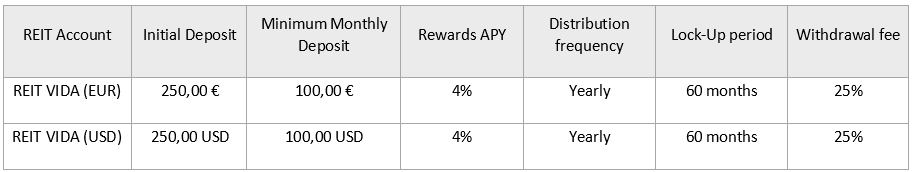

12. REIT VIDA ACCOUNT

12.1. Subscription

To deposit in the EQapital Trust’s REIT VIDA account, the client can make a deposit (SEPA or SWIFT) into his EUR REIT VIDA or USD REIT VIDA account. For those who are already customers, it will be enough to make an internal transfer from their EQapital Trust’ accounts.

12.2. EARLY WITHDRAWAL REQUEST

The client can request the withdraw from his REIT VIDA account at anytime. In case the client requests total or partial withdrawal before the expiry of the active Lock-up period, the withdrawal fee will be applied.

Withdrawals requested from January 1st to June 31st will be released on January 10th of the following year (or the next business day).

Withdrawals requested from July 1st to December 31st will be released on Jul 10th of the following year (or the next business day).

12.3. RETURN OF PRINCIPAL AND REWARDS

The VIDA Rewards will be added on a six-monthly basis to the deposits made by the customer.

At the end of the active lock (60 months) the customer will be able to withdraw all or part of the balance in his VIDA account.

The customer will receive a report via e-mail with instructions on how to withdraw or continue the participation on the VIDA project.

12.4. GENERAL CONDITIONS

To keep the VIDA program active, the client must deposit an amount equal to the Minimum Amount or greater each month.

The Client has the option of making additional deposit an amount equal to the Minimum Amount or greater each month.

If the deposits will be interrupted the following will happen:

if the minimum balance is not deposited by June 31st, it will no longer be possible to deposit into the account and the deposited funds will be refunded on January 10th and the early exit fee will apply. Unless the minimum amount due is paid by June 30th.

If the minimum balance is not deposited by December 31st, it will no longer be possible to deposit into the account and the deposited funds will be refunded on June 10th and the early exit fee will apply. Unless the minimum amount due is paid by December 30th. The minimum balance deposited means the 6 months of monthly deposit that the customer needs to fulfill based on the present Conditions. The minimum amount due is 600 EUR or USD, i.e., 6 months’ payments of 100 EUR or USD

13. REIT Vault

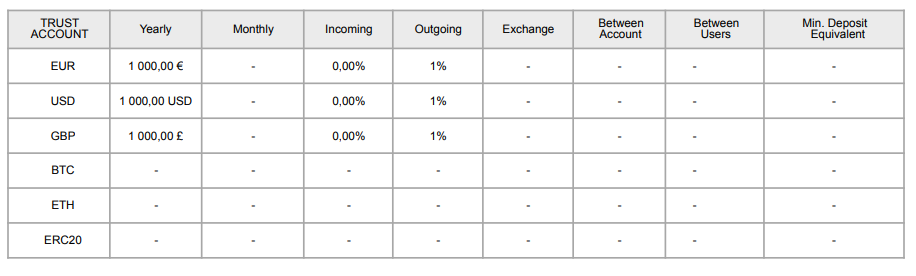

14. Trust ACCOUNT

*EUR, USD and GBP accounts will only be opened upon request and the yearly fee will be

totally charged when you first activate the account, and then around the same time every 12

months after that.

If the client requests the activation of a Trust account and at the same time the client has an

active deposit in REIT USD, REIT EUR, VAULT EUR, VAULT USD account or subscription to the

REIT service VIDA, the TRUST account will be free of charge.

15. Bit Shot – promo valid for the period 14.03.2023 to 22.03.2023