Do you have questions?

We are here to help you! On this page you will find all the frequently asked questions about our products. But if you don't find the answer you're looking for, we're here to help via chat or email.

General question

A traditional trust account is a legal arrangement by which funds or assets are held by a third party (the trustee) for the benefit of another party (the beneficiary) and normally entering into a Trust can be quite expensive, in fact it is usually used by people with millionaire fortunes. Through our trust account you can enjoy the same legal benefits but in a smart and economical way.

In fact, with EQapital you can register to our Custody&Vault account and get a Trust account. Although the Trust account is inside the same platform, to have it activated you will have to request the Support Team to activate it for you. How to do it? In the dashboard, next to your name, click on the letter and write them a message about your request to have a Trust account in EUR or USD which you can start depositing your assets thus obtaining protection.

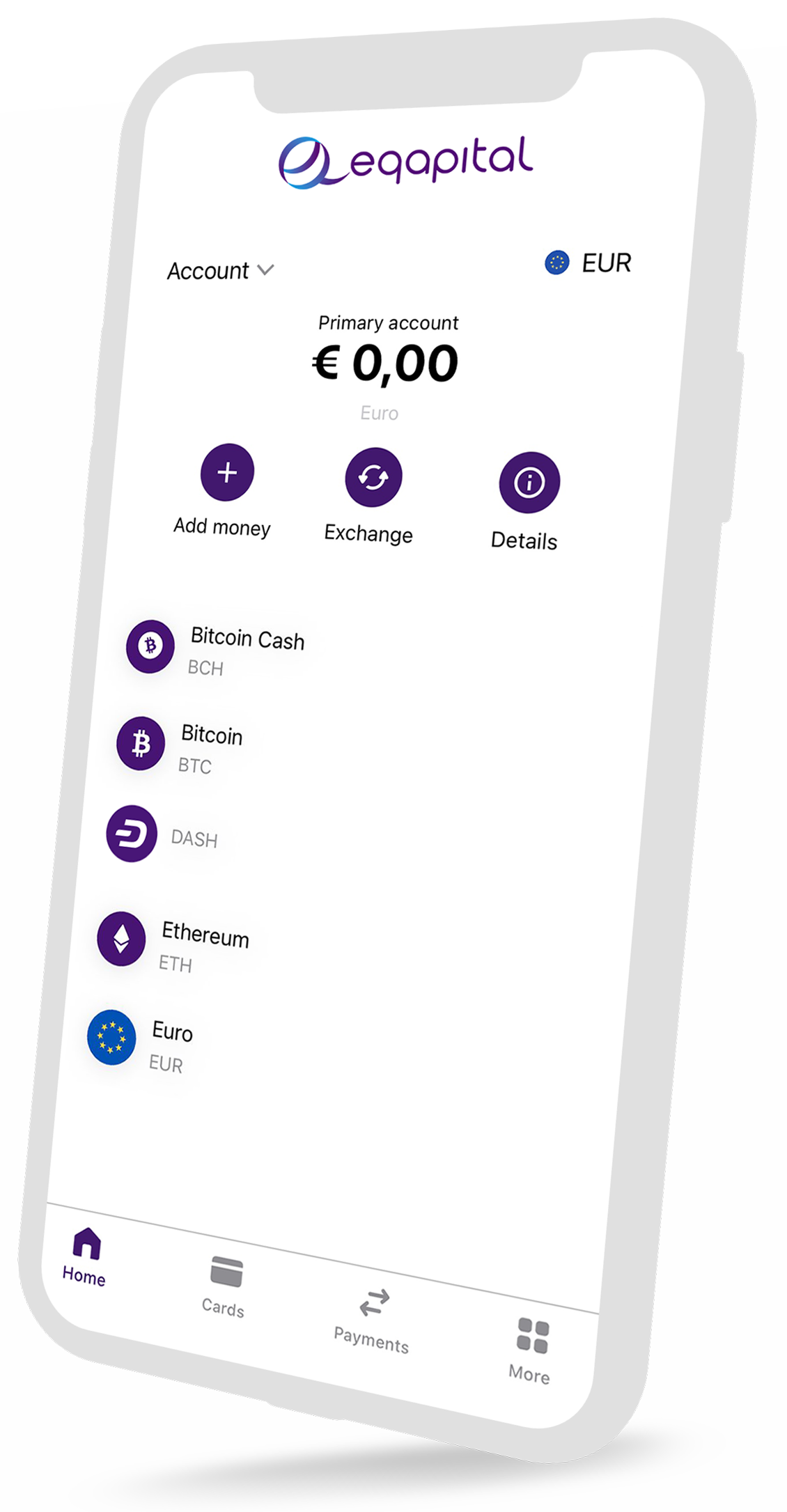

Our platforms support deposits, transfers or even exchange in the following legal currencies and crypto-currencies: USD, EUR, EURST, GBP, BTC, BCH, ETH, USDT, USDC, DASH, LTC.

Correspondent and intermediary banks (third banks who intermediate transactions between EQapital and your other bank), charging fees, or even different exchange currency rates can cause differences on amount you’ve planned to receive.

In order to ensure prompt allocation of deposits to your account, we recommend you to send payment receipts of the executed incoming transfers to our Support email (support@eqapitaltrust.com).

In case of not seeing a transfer received in your account within the reasonable time frame, we also recommend that you email us and send the payment receipt, in order to assist you.

You can check all our fees by clicking on the link below:

A Trust greatly expands your options when it comes to managing your assets. The traditional meaning of Trust refers to the legal relationships created - inter vivo or in the event of death - by a person (the settlor), when the assets have been placed under the control of a trustee for the benefit of a beneficiary or for a specific purpose.

Here some features:

- The assets constitute a separate fund and are not a part of the trustee's own estate.

- Title to the trust assets stands in the name of the trustee or in the name of another person on behalf of the trustee.

- The trustee has the power and the duty, in respect of which he is accountable, to manage, employ or dispose of the assets in accordance with the terms of the trust and the special duties imposed upon him by law.

EQapital is an asset and digital asset management TRUST, legal service and third-party fiduciary.

The difference is that with EQapital Trust accounts through our Custody&Vault platform you can ensure the privacy and protection of your assets.

However, even if your assets are in custody with EQapital Trust, you will be able to do whatever you ask us to do!

Trust is regulated and have a specific law. To know more about it click the link below and read the Convention of 1 July 1985 on the Law Applicable to Trusts and on their recognition.

https://www.hcch.net/en/instruments/conventions/full-text/?cid=59

As a secure and regulated bridge between the banking system and blockchain, EQapital allows individuals and businesses to seamlessly manage all types of currencies in their daily operations and smoothly transition to the digital economy.

With EQapital our clients can explore and transform their financial lives and the way they operate their assets.

The deposit reference tells our systems that a deposit is meant for your specific eQapital account and lets it assign the deposit to your account. Please read the deposit instructions thoroughly and include a reference if it is listed.

How to add it?

When you are making a transfer, there are fields to fill in as " “ Reference ”, "Message to receiver", “ Reference to sender ”," Remittance Information "or similar and you just have to write down your Reference.

What happens if you forget to include it?

If you do not fill in the "reference" field, we will have to try to do it manually. In this case, We may ask you to submit documentation proving the deposit was sent from your bank.

Basic KYC (Euro) | Full KYC (EUR) | |

POS Limite di transazione singola | 250 | 20,000 |

Limite di spesa giornaliera POS (20 tr. Al giorno) | 10,250 | 20,000 |

Limite di prelievo ATM | 80 | 500 |

Limite di prelievo giornaliero ATM (5 tr. al giorno) | 80 | 2,500 |

Limite di carico giornaliero | 1,250 | 5,000 |

Limite di carico mensile | 10,250 | 20,000 |

Limite di carico annuale | 10,250 | 80,000 |

Saldo massimo della carta | 250 | 20,000 |

IMPORTANTE: se si desidera aumentare il limite della carta riportandolo a “Full KYC”, è necessario fornire al nostro team di assistenza le versioni aggiornate dei documenti necessari.

Available only for citizens and residents of:

Aaland Islands, Austria, Belgium, Bulgaria, Croatia – Hrvatska, Cyprus, Czech Republic, Czechoslovakia, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Guadeloupe, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Monaco, Netherlands, Netherlands Antilles, Norway, Poland, Portugal, Reunion, Romania, Saint Martin, Slovakia, Slovenia, Spain, Svalbard, and Jan Mayen Islands, Sweden, Switzerland, United Kingdom.

Cards can be used in any country.

Do you have more questions?

FAQ KYC

In compliance with the AML and CTF regulations, EQapital customers, in order to enjoy all our services, must complete the KYC (Know Your Customer) for an individual or KYB (Know Your Business) to "corporate" customers.

After registering, a list of documents will appear. It will depend on the type of account (individual or business). Also, documents may vary depending on the country of origin.

Once finished all opening verification steps, you’ll be able to immediately enjoy all benefits of having an EQapital account.

In order to verify your company, please provide the following corporate documents:

- A document confirming the legal existence of the company, such as:

- certificate of incorporation/registration

- recent excerpt from a state company registry

- certificate of incumbency

- certificate of good standing

- Memorandum/articles of incorporation/association/registration

- another similar document;

- a document allowing to establish all the UBOs of the company, such as:

- shareholder registry

- statement of information

- recent excerpt from a state company registry

- certificate of incumbency

- memorandum/articles of incorporation/association/registration;

- trust agreement (if applicable)

- another similar document.

Please note:

All documents must be in English, otherwise you must provide a certified translation for each document.

The documents you provide must in any event contain the company's name, registration number, legal form (type), address, and date of incorporation.

If your entity has several corporate layers, i.e., intermediary holding companies, please provide the relevant documents in respect of each company.

Bank statements are normally NOT accepted as confirmation of UBO status.

Definition: An Ultimate Beneficial Owner (UBO) is an individual that benefits from or is positively impacted from a company even though they are not formally named as the owner of a business.

It’s no secret that one bad selfie can ruin your day. However, we're talking about something more serious than losing a couple of right swipes on a dating app. The inability to pass remote identity proofing can cost you anything from a gaming account to an important online transaction.

Below, you will find short and fun instructions that will help you to prove your ID ownership, without putting in heaps of time and effort.

- Stay In Focus

If you are asked to take a photo of yourself holding your proof of identity, first of all, make sure that your ID and face are fully visible and in focus.

Here are a few simple tips that can help:

- Avoid dark rooms and strong background light

- Go for a smartphone camera and not a webcam, if you can choose

- Clean the camera’s lens

- Take a photo with a steady hand or use a tripod

- Be Yourself

Use the ID documents in which you resemble your current self the most. Remove hats, headphones, glasses, and other things that can make you harder to recognize.

These 2 simple recommendations will help you to get verified in a matter of seconds. Though if you still experience any issues, please contact our support team.

Our standard check for personal accounts normally takes about 3 minutes, while for business accounts it can take up to 24 hours.

For both, in case of difficulties, it may last for up to 24 hours to you receive a check result. If during this period you still don’t receive a reply, please contact our support team (support@eqapitaltrust.com). We’ll do our best to respond as soon as possible!

Common proof of residency examples:

- Utility bill for gas, electricity, water, internet, etc. linked to the property (the document must not be older than 3 months);

- Landline telephone bill;

- Bank statement with the date of issue and the name of the person (the document must be not older than 3 months);

We do not work with the following documents as they cannot confirm your place of normal residence:

- Checks;

- Envelopes with the address as a confirmation of your address of residence;

- Parcels with the address on stickers as a confirmation of your residence address;

- Insurance documents;

- Medical prescriptions, receipts, invoices;

- Pre-paid card invoices;

- Mobile sim cards.

- Tax Bills.

We also don’t work with pieces of documents and screenshots. If your document has more than one page, please provide us with all the pages.

Providing proof of address is a common step for account openings at regulated financial institutions. Proof of Address Verification Steps:

- Create an account/request a transaction. Each time you attempt to open an account with a regulated entity or complete a transaction you are asked to confirm your identity by taking a photo of your ID/Passport/Driving license;

- Upload your Proof of Address: Upload a PDF Format of your POA and upload it to the system;

- Wait for the documents to be checked. Keep in mind that if your document consists of more than one page, you need to upload each one of them;

- Receive a status message: The system informs you of successful verification or explains what needs to be done in order to get verified.

Your documents must be valid for at least a month. We will not be able to validate expired documents. If you attach a utility bill or bank statement, they must have been issued within the last 3 months and be printed on the official form.

- Create an account/request a transaction: Each time you attempt to sign up for a regulated entity or commit a financial operation, you are asked to confirm your identity by taking a photo of your ID and uploading a selfie with it.

- Upload an ID document: Take a photo of your ID and upload it to the system.

- Wait for the image to be checked: Make sure the photo of your ID is authentic and clear, and that all the important information is easy to read - this will save you time.

- Upload a selfie with your ID document or pass a liveness check (if required): Make sure your face is clearly visible within the camera frame and that you follow the instructions given by the system or pass an operator-assisted check: Join a live call with an operator.

- Receive a status message: The system informs you of successful verification or explains what needs to be done in order to get verified.

To guarantee successful verification, please make sure that the photos of your documents meet the following requirements:

General:

- The uploaded file is an original photo (static image) in JPG.

- The photo has been taken today.

- The size of the uploaded file is no less than 100 KB or 300 DPI.

- The photo is in color.

- The information in the document is readable.

- All the corners of the document are visible and no foreign objects or graphic elements are present.

- The document is valid.

- The identity document photo has not been edited with any graphics software or converted to PDF.

ID Document Requirements

- If the document has two sides photos of both sides are uploaded.

- The document is valid for at least one month from the upload date.

- The document isn’t scratched, stained or torn.

- The user’s full name, date of birth, MRZ, and other important information is present and can be read.

POA Requirements

- The document must be issued within the past three months, with the issue date visible. The issue date must be visible.

- The document isn’t scratched, stained, or torn.

- The user’s full name, date of birth, signature, and other important information is present and can be read.

- The document is issued by an official authority.

- If the document consists of more than one page, you need to upload each one of the pages.

Common Issues with Document Photos

The following list provides solutions for the most common document denials.

Issue | Solution |

Watermarks | Make sure you aren't using any third-party camera apps that leave a watermark on the photos. |

Blur | Place your document on a flat surface and hold your mobile phone in parallel with the surface when photographing the document.

If you're using a laptop or a desktop webcam, make sure that your elbow is in firm contact with the table while holding your document in hand.

Don't position your camera too close to the ID document.

To ensure that your camera is in focus, try tapping the screen of your mobile phone to force-focus on a specific object. |

Glare | Avoid photographing your ID document under direct light, especially if your ID document has a light-reflecting surface. |

Missing info

| Photograph your document on a flat surface making sure the serial number, hologram, photo, MRZ, etc. are clearly visible (this may require slightly tilting your ID). |

Foreign objects/persons | Make sure that no one else is visible or partly visible in the photo and that you are not covering any of the data with your fingers. |

Graphics software signs |

Do not edit the photos. |

Poor quality | Use a high-resolution camera and don’t resize the file before uploading it. |

Please do your best to follow the guidelines and tips you see on the screen. If you failed verification, don’t get upset. Read the rejection message you get carefully and try again. We are doing our best to provide clear instructions on taking and uploading photos. However, these rules may vary depending on the policies of the verifying service.

You have nothing to worry about! If you have trouble with the KYC procedure, we kindly ask you to schedule a meeting with us on this link:

In compliance with the AML and CTF regulations, KYC (Know Your Customer) or KYB (Know Your Business) procedure is required in order to verify the identity of the client or the corporation.

As an individual account we need you to provide the following:

- You must provide the identity document in jpg format:

- It must not be expired;

- Clearly legible;

- Without reflexes;

- In the photo keep at least 1 cm around the edges, that is, take the whole document and not a part;

- You can use your identity card or passport

Selfie with document:

- Take a selfie by placing the document you used above;

- Place it under the chin or to the side of the face;

- The document must be legible without reflections;

- The face must be completely taken up and not covered by glasses or hats.

- Proof of residence:

- It is necessary to indicate a document certifying the residence indicated in the identity document;

- The document must not be older than 90 days;

- Tax notices, self-declarations, residency certificates, car insurance or screenshots are not valid.

In order to verify your company, you need to have an individual account and then you will need to provide the following corporate documents:

- A document confirming the legal existence of the company, such as:

- Certificate of incorporation/registration

- Recent excerpt from a state company registry

- Certificate of incumbency

- Certificate of good standing

- Memorandum/articles of incorporation/association/registration

- Another similar document

- Bank statement of the company

- POA of the company (rental agreement or utility bill)

* For company we do not accept bank statement

- A document allowing to establish all the UBOs of the company, such as:

- Shareholder registry

- Statement of information

- Recent excerpt from a state company registry

- Certificate of incumbency

- Memorandum/articles of incorporation/association/registration

- Arust agreement (if applicable)

- Another similar document.

3. Ultimate Beneficial Owner (UBO)’ s documents

- Verify the administrator of the company

- Every shareholder starting with 25% shares of the company must be verified.

4. A clear photo of your passport or ID card

- Must not be expired

- Clearly legible

- Without reflections

- in the photo keep at least 1 cm around the edges, that is, take the whole document and not a part

5. Selfie with passport or identity card.

- Take a selfie by placing the document you used above

- Place the document under the chin or on the side of the face

- Looking straight at the camera

- The selfie photo must be in colour

- The photo is made on a light and neutral background.

- The photo does not have the "red eye" effect.

- DOES NOT wear sunglasses, hat or headband.

6. Proof of address

- It is necessary to indicate a document in pdf certifying the residence indicated in the identity document such as: Bill or bank statement

- The document must not be older than 90 days

- Tax notices, self-declarations, residency certificates, auto insurance or screenshots are not valid.

Try completing the fifth step from your laptop or PC. If you’re still facing the same problem, contact our support team through an email (support@eqapitaltrust.com).

Your account will not be verified. Due to security reasons in order to enjoy our services, you must complete the KYC/KYB procedure.

To assist you in the best way possible, please send your documents to help@eqapitaltrust.com.

FAQ Custody&Vault

With our Custody&Vault platform, you have the possibility to get four accounts by default and a TRUST-type account.

With TRUST-type accounts, with which you get total protection and greater privacy thanks to the TRUST Custody service, with which you can protect your personal or company assets from unforeseen events.

Two REIT accounts (EUR & USD), which allow you to participate in Real Estate transactions starting from just $500, managing your funds directly from our App, getting periodic updates, and in one of the best historical markets in the world: Florida.

To register choose one of the links below:

WEB Version: https://eqapitalbanq.wallexcustody.com/sign-up

APP iOS: https://apps.apple.com/br/app/eqapital-banq/id1568137494?l=en

APP Android: https://play.google.com/store/apps/details?id=com.crassula.eqapitalbanq&hl=pt&gl=US

Prime is commitment to provide the highest level of quality and importance. We, at EQapital, want you to feel special by becoming a Prime Client.

- PROTECTION AND PRIVACY over your assets: A Trust account offers Custody Service which means taking care of your assets and do whatever you tell us to do! Once these assets enter your trust account you start having total privacy.

- FLEXIBILITY: Even if you have your assets in the EQapital Trust account, you can still make deposits, make European and international transfers, send money between accounts or between EQapital users or even exchange to another currency instantly and see in real time the amount that will be received.

- EQapital CONCIERGE: Dedicated and exclusive consultancy for PRIME clients, with a monthly newsletter in real time on world stock markets, futures, indices, commodities and cryptocurrencies, you obtain a consultancy with the highly competent EQapital professional, capable of advising on every financial requirement and monthly webinars with an expert who will teach you all about the financial market.

In order to upgrade to a Prime Account, you need to open a Trust Account on our Custody&Vault platform. Although the Trust account is on the same platform, you must request that the support team activate it for you. How to do it?

- If you are using PC or Laptop: On the dashboard, next to your name, click on the letter and write them a message about your request to have a Trust account in EUR ,USD, BTC or ETH.

- If you are using your mobile phone: On the dashboard, in the top left, there are 3 lines. Click on them, then click on messages. In the top right corner, you will find an arrow. Press on it and write them a message about your request to have a Trust account in EUR, USD, BTC, or ETH.

Or you can send a request by contacting our support team through an email (support@eqapitaltrust.com).

A Trust Account is a type of account that offers security and protection for your assets thanks to the custody service.

However, even if your assets are in our custody, you are the one who decides how you want to use your money. Whether for day-to-day banking transactions or for applying money to earn rewards.

Once you have opened an account with our Custody&Vault platform, you get four accounts by default.

Real Estate:

- REIT(EUR)

- REIT(USD)

To learn more about Real Estate: https://eqapitaltrust.com/faq-real-estate/

To open an account with us:

WEB Version: https://eqapitalbanq.wallexcustody.com/sign-up

APP iOS: https://apps.apple.com/br/app/eqapital-banq/id1568137494?l=en

APP Android: https://play.google.com/store/apps/details?id=com.crassula.eqapitalbanq&hl=pt&gl=US

Click on the link below, enter your email and follow the instructions that will arrive in your email.

Contact us through support@eqapitaltrust.com and we will respond as soon as possible!

You can put EUR, USD, BTC, & ETH under Trust’s protection.

On the dashboard, on the left, choose “Transfers”, then pick the type of transfer you would like to make and fill in the required information.

FAQ Neobanking

A NeoBank (also known as an online bank, Internet-only bank, virtual bank, or digital bank) is a type of direct bank that operates exclusively online, without traditional physical branch networks. With our NeoBanking platform our client can make transfers, payments, exchange, have multiple accounts and more, in Fiat or cryptocurrency. All in one place.

a. Download the app Google Play or App store or access the link here

b. Then choose the type of account

c. Fill the form with your information and create a password. If you have a referral code, please enter it in the field.

d. Read and accept the terms and then click on ´create account´. An email will be sent to you. If not, please check your spam box.

e. Once you receive the email, click on ´verify your email address´ And then you will be redirected to your account login page.

At this point you already have access to your EQ NeoBanking account, but you need to go through the KYC procedure to use the full functionality.

a. Click on ´Verify account´.

b. Enter your phone number and you will receive a confirmation code via SMS.

c. Now is the time to upload photos of your documents. To do this, just click on 'Upload' and follow the instructions.

d. Just wait a few moments for the system to validate the documents, and you're done! Your account is ready to use.

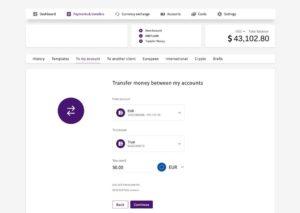

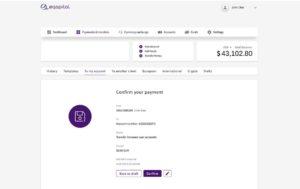

a. Go to ´Payments & transfers´

b. Click on ´To my account´

c. Select the account from and to account, fill the amount and currency.

d. Then click on ´Continue´

e. Check if all the information are correct and confirm.

Congrats! You´re done.

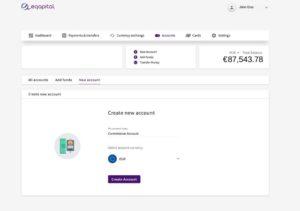

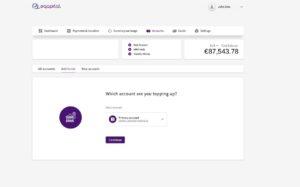

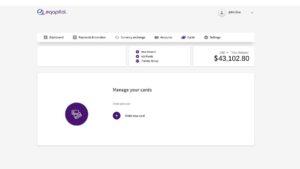

a. On your dashboard, click on 'New account'

b. So choose a name for your new account and a currency or cryptocurrency.

c. click on ´create account´.

That´s all! Your account is created and ready to use!

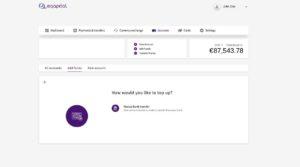

a. In your dashboard, click on 'add funds'

b. Select the account you want to add funds to and continue

c. So click on ´Manual bank transfer´

Then you will have the necessary information to make the transfer to your Neobanking account.

IMPORTANT: When filling in the data, don't forget to fill in the reference number and/or payment details

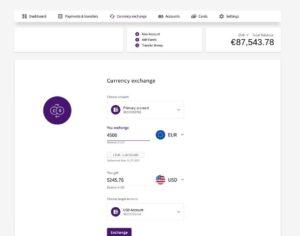

a. Go to ´Currency exchange´

b. Select the account from, fill the amount and currency or cryptocurrency.

c. Select the currency or cryptocurrency that you want exchange to

When you fill in this information, you will already see the value that will be converted.

d. Select the account you want this exchange go to

e. Confirm by clicking on ´Exchange´.

Fatto!

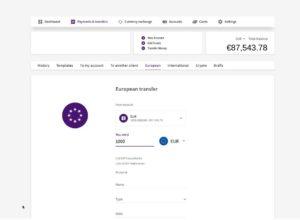

a. Go to ´Payments & transfers

b. Click on ´European´

c. Select the account from, fill the amount and currency.

d. Enter the recipient's information

e. Then click in ´Continue´

It´s done!!

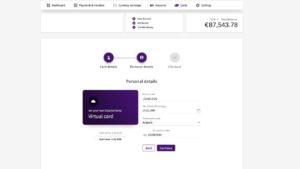

Once your account is open and verified, you will be able to request your *EQapital debit card.

*At the moment the EQapital debit card is only available to customers in Europe.

a. From your Dashboard menu, click on ´cards´

b. Click on ´Order new card´

c. Fill in the requested data and continue

Ready!

Now just wait for your exclusive debit card at your address, and has a deadline of 25 to 30 working days.

To make a funds transfer to your prepaid card just click on Transfer and than on Card Funding Transfer, as you can see below:

After clicking, follow the steps bellow:

a. Choose the account (DEBIT FROM);

b. Select card;

c. Enter the amount to Transfer;

d. Continue;

If you want to save the information to make a recurring transaction without having to type and select everything again, just click SAVE AS TEMPLATE and when making the next transaction just choose the template.

Now you can withdraw your money at any ATM or use your card for everyday expenses.

If you want to make a transfer to another bank account (Outgoing Wire Transfer) just follow the steps below:

First click on Transfer then on Outgoing Wire Transfer as you can see in the Image,

There are 5 options, click on the third icon (Outgoing wire Transfer)

a. Choose the account to be debited

b. Type all the information carefully

After filling in all the information, click on Continue and mission accomplished, you’re done!

- Open the Neobanking App

- Go to "More"

- Click on "Contact Information"

- On the top right corner there is a pencil, click on it.

- Now you are ready to change your email/number!

- Open the App

- On the dashboard, click on "Payment"

- Choose "History"

- Log in the App

- Go to "More"

- After that choose "Username"

- Then "Edit".

Domande sul Real Estate

Thanks to its Custody&Vault platform, today EQapital Trust is extremely advantageous, simple and fast, available to all customers who want to start a planning strategy for their assets, by participating as a lender of real estate projects in the USA, one of the largest and best real estate markets in the world.

This type of participation will have Crowdfunding parameters but without intermediaries, since EQapital Trust will also represent the promoter company as owner of the marketed properties.

Each EQapital Trust customer will in fact be able to access the platform and make contributions in FIAT or Cryptocurrency, with a minimum amount totally accessible to any customer and thus participate in the operation.

A great advantage will be the protection offered by the trust structure (TRUST) of EQapital Trust, with its network of European and American depository banks, extending to the customer all the advantages that this type of structure offers, as well as leaving the capital and custody interests directly in your Trust account

The minimum amount to apply funds in Real Estate operations through our platform is €500 and the maximum amount is €450,000. For applying funds above €450,000 please contact our Support Team and inform the desired amount.

EQapital will have in its portfolio of opportunities different types of projects that will be proposed by the "Promoter", also belonging to our TRUST, which is the Real Estate development company, thus being able to diversify the capital made available by the PARTICIPANTS.

Our risk evaluation and analysis team carry out an exhaustive and detailed study for each project, seeking a balance between return and risk.

Deposits made by the PARTICIPANTS will always remain in TRUST, therewith always having, from the deposit until his return with the revenues, the guarantee of keeping his deposits under EQAPITAL TRUST service.

Once the deposited amounts must leave the TRUST to be applied in the purchase of properties, before entering the current accounts of American banks indicated by the owners, they will be deposited in an "Escrow Company" partner of EQapital, whenever EQapital deems necessary.

Therefore, our client can have a great advantage. Through the investment fund managed by EQapital, the PARTICIPANT can make his money available already knowing that it will be direct to the properties’ owners, who will be part of the “Developed Project”

Every investment has risks in any sector. Although we ensure a high level of know-how of all the actors participating in the operation, some operations in real estate can be affected by delays or other problems, meaning in the worst case, the total loss of value. Despite this, there is a fixed asset underlying the investment, which makes the total loss of the investment more difficult.

The main risk of this activity is the financial liquidity, for which the property could take longer than expected to be sold. Devaluation of properties and legal problems can also be a risk. Therefore, firstly we have chosen a healthy market, where negotiations have increased every day, making the probability of a property devaluation much lower than elsewhere, even in crisis scenarios.

The properties that we seek, sometimes have legal or material obstacles, such as documents evaluation and correction, repair or renovation required, which make it less valuable than appear. Therefore, as many knowledge and information we have, as lower the investment risk.

EQapital has as partners, companies and professionals with extensive market knowledge and more than 40 years of experience, which guarantee us a secure and profitable negotiation. Even so, our partners group, specialized in legal and bureaucratic matters, is also always available to assist us.

Anyone of legal age or a company not resident in restricted geographic areas, is sufficient to fulfill the requirements established by the anti-money laundering legislation.

To start investing and enjoying the benefits of being a EQapital Real Estate customer, you need to register on the platform and create a profile, where you will need to enter some information about yourself. A FIAT (EUR and USD) TRUST Account and a BTC TRUST Account will be assigned by default.

All of it is necessary to comply with the current legislation of the EUROPEAN DIRECTIVE AMLD5. Your data is treated with the utmost confidentiality and all financial transactions are managed securely by our TRUST, which offers protection, privacy and flexibility for the assets exchange.

EQapital is an American "Statutory Trust", that offers to its customers custody, protection, privacy and asset planning solutions. With the additional possibility of carrying out digital banking operations such as deposits, local or international wire transfers, exchange service and e-commerce, you or your company can also be able to receive payments directly through its intuitive and easy-to-use platforms.

To authorize the creation of funds and financial transactions, EQapital Trust has a legal fiduciary vehicle - TRUST - and our compliance is the same followed by conventional banks and operate in accordance with Wallex Bank, an institution with credibility and recognition worldwide.

Thanks to our trust structure and the network of European and American custodian banks, our clients can participate in real estate transactions in the US market, specially focusing on Florida State, without worrying about:

Exposure to the Banking System

With EQapital our customers avoid the risk of having blocked accounts or paying high tax rates when making international transfers, just making a simple "transfer". After registering an EQapital Custody&Vault account through our App or website, a trust account in different currencies (EUR, USD, BTC ...) will be automatically linked to the customer, allowing it to carry out digital banking transactions. By adding funds to this account, our customer can choose the “Real Estate” product within the Custody & Vault platform and allocate a desired amount of capital for that transaction, just in a few clicks.

Global Management

Time, costs, and specific laws to invest in Real Estate abroad, such as to open current accounts, to hire foreign accountants and lawyers, to deal with notary’s offices and to work with foreign real estate agencies, can preclude any investment. Besides of carrying out international bank transfers, depending on at least 3 financial institutions, everything without the privacy guarantee.

Count on us to make it easier and comfortable, managing everything wherever and whenever you want, through our App and website platform.

EQapital Trust has agreements with many institutions and professionals in the market separately, ensuring that all these players work in accordance with both European and American legislations. Our commitment is to assure the correct management of investment risk, privacy protecting, avoiding inadvertent tax penalties or financial crimes, and ensuring attractive profit margins. To protect its customers and ensure the transaction’s success, EQapital Trust has legal structures such as a network of custodian banks that guarantee and authorize payments, legal partners that help us to prevent financial crimes, all together working strictly in accordance to European and American anti-money laundering and anti-terrorism regulations.

Cryptocurrency and Blockchain Learning

Crypto or cryptocurrency is a digital currency that can be used to buy goods and services based on blockchain technology—a distributed ledger imposed by a varying network of computers.

Our platforms support deposits, transfers or even exchange in the following legal currencies and crypto-currencies: USD, EUR, GBP, BTC, BCH, ETH, EURST, USDT, USDC, DASH, LTC.

- Freedom of transactions

With digital procedures performed on the Internet, the cryptocurrency market does not stand still. Unlike the stock market, which has specific times in each country, using cryptocurrencies you can buy or sell your assets on any day and at any time.

- The largest circulation in the world

Since they are decentralized currencies, cryptocurrencies are not limited to the geographic borders of countries. So, if you have a digital currency, you can move it to any region of the world.

- Ease of transactions

The use of digital currencies allows for the inclusion of users without banking constraints, ensuring interaction on a larger scale for buyers and sellers, as transactions only require access to the internet.

- Security for records

Each digital currency is unique due to its encryption technology. Therefore, only you have access to your definitive record of purchases, payments or transfers, which ensures greater privacy for your transactions

Firstly, you need to decide the amount you want to buy and the currency after checking the details. You can easily buy crypto from our platform and store it or exchange or sell and pay. All the currencies you buy are saved in the wallets in your account.

Before buying, you must have funds available in one of the accounts of your choice. Then simply from the exchange option choose which account to take the funds from and in which currency you want to convert them, finally indicate the amount and confirm the transaction. Well now you are the owner of cryptocurrency; exchange, keep it or pay from your account.

Stablecoins are a bridge between cryptocurrencies and the traditional economy as the value is guaranteed by a national currency. It is digital asset that is as decentralized as Bitcoin, but doesn't change its value hourly. Its value is linked to an external asset, for example 1 EURST = 1EUR or 1USDT = 1 $ and 1 USDC = 1 $ by obtaining both the speed and cheapness of a crypto currency and the security and stability of a national currency.

Stablecoins offer advantages over traditional forms of fiat currencies, including much faster transaction settlements, low transaction fees, layer of privacy, and self-custody.

The market needed an asset that can be used as a store of monetary value and can act as a medium of exchange. To buy stablecoins you’ll need an account with a crypto exchange or a digital wallet where you can buy crypto directly. And guess what? You can do it with us.

Tether (USDT) appears as an attractive alternative for buyers, and EQapital Trust tells you why.

Launched in 2014, Tether is a digital currency classified as a stablecoin, as it is backed by a legal one (in this case, the dollar is the US currency). This means that 1 USDT will always be worth US $ 1.

This differential has ensured increased attention from cryptocurrency buyers and has turned Tether into one of the world's leading digital currencies, alongside Bitcoin (BTC) and Ethereum (ETH).

Knowing the importance of cryptocurrencies in the segment, EQapital has separated 3 reasons to start doing transactions on Tether:

Low Volatility: Because it is pegged to the dollar, Tether tends to be more protected from the price fluctuations common to the cryptocurrency market. It can also be used as a hedge against the instability of other digital assets.

More Convenience: Buying Tether is also seen as a more practical way to buy and avoid currency fees, as well as being easier to buy in values.

Faster: Tether to carry out financial transactions much faster and without bureaucracy, ensuring short-term transactions for buyers by being, a source of liquidity for the market.

The US Dollar Coin is a stablecoin that has the same value with the actual US Dollar. Basically, giving some very needed stability in the market. USDC offers the stability and desirability of the US Dollar with the speed of cryptocurrency transactions. The US Dollar Coin was created in a joint move by Coinbase, cryptocurrency exchange, and Circle, a crypto finance company.

It’s regulated by the government’s Financial Crimes Enforcement Network (FinCEN), which combats money laundering. USDC offers the stability and desirability of the US Dollar with the speed of cryptocurrency transactions.

EUR, USD, BTC, & ETH are under the protection of Trust!

Staking is the process of buying and holding coins with the goal of receiving interest. You get a certain cryptocurrency and not trade for specific period of time, and if the transaction is legitimate, you’ll receive reward.

A blockchain is a place where data is stored in a very effective manner. A “block” is the place where data is stored and different types of information are recorded.

Each block has some information from the previous block, and this forms a connection or “chain” between each block. Moreover, blockchain is decentralized which means there is no single, central figure governing it.

Investing in cryptocurrencies is a smart way to diversify your portfolio.

It is a good way to earn passive income. Moreover, cryptocurrency is reliably protected and cannot be faked. They are not controlled nor regulated.

EURST is the only stablecoin in the world guaranteed by the US dollar with a value of 1 euro and verifiable in real time. This currency offers a deposit guarantee of up to $250,000 directly from the Federal Reserve, the central bank of the Americas.

It offers all the guarantees of a stable currency that does not fluctuate. Also, users can use EURST instead of FIAT when depositing funds in cryptocurrency exchanges for trading use.

And even workers abroad can use EURST to bypass expensive transfer fees, charged when making legal remittances to their families at home.

We kindly ask you to contact our support team through an email (support@eqapitaltrust.com) to check that for you.